Since the publication of the last post, it has come to the attention of the authors of this blog that many parents and taxpayers thought the Fort Cherry Elementary PTA purchased the awards for the Accelerated Reader Program. Actually, purchasing prizes and awards is something that the FCEC PTA used to do all the time. It appears that Jacoby has taken over some of the duties previously handled by the dedicated parents of the PTA.

In this post we are going to take a look at the expenses incurred by Trish Craig for the Barnes & Noble Book Fair fundraisers, another example of an event that could be, and should be, handled by the PTA.

The authors of this blog are wondering if Fort Cherry’s Parent Teacher Association now stands for . . .

Principal . . .

Taxpayer money . . .

Administration . . . ?

The Barnes & Noble book fair is promoted by the District as a fundraiser.

Under the guise of preparing for this fundraiser, Craig and the other administrators arbitrarily spend taxpayer money – a lot of tax money.

The taxpayers do not know what profit is made and how the profit is distributed among the “recipients” listed on the flyer – “the School Library, books for Fort Cherry Students in Need, and Accelerated Reader Books for the Classrooms”.

The flyer mentions only one library. What about the high school library? During this whole B&N event, the high school appears to have been overlooked. How does this event benefit FC high school?

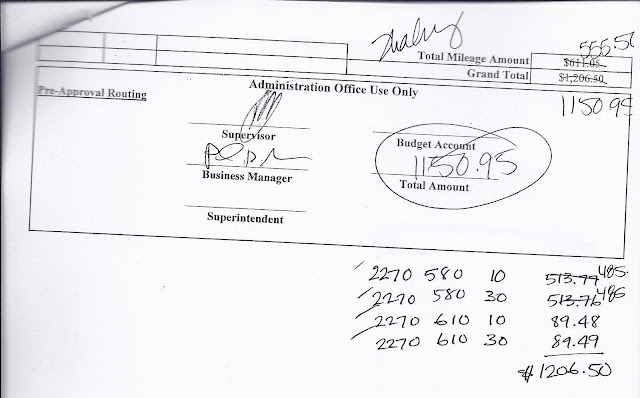

Sroka's high school line item budget has been used time and time again to cover the excessive funds needed to cover the elementary expenses. You will see on the reimbursement forms submitted by Craig that her expenses are split evenly between the elementary (code 10) and high school (code 30).

In addition, the taxpayers do not know if the administrators benefit from any perks or rewards of books, materials, etc.

As you read this, keep in mind that expenses for the book fair are submitted by other administrators, not just Craig.

For example, Dinnen submitted a receipt for a November 10, 2010, B&N “coordination meeting” lunch at Scoglio for Craig, Jacoby and himself that cost taxpayers $83.58. See October 12th post, “FC Administrative and Board Expenses . . . Doing the "Doo Wop" at Taxpayers' Expense”. http://fortcherryinfo.blogspot.com/2011/10/fc-administrative-and-board-expenses.html

The authors of this blog did a little research into the B&N Book Fair. Here’s what we found after talking to a Market District B&N representative:

B&N does like to meet with the school (but it doesn't have to be as many times as Craig met with them). They could even do this by phone or through emails.

When asked if administration usually plans the book fair, the B&N representative responded by saying that it's usually the PTA, since administrators usually have a full plate.

The B&N representative said PTAs have the time and are usually more successful than a busy administration when it comes to putting on a book fair.

How funny that the B&N representative would say administrators usually have a full plate.

In FC’s case that can be taken literally, as administrators have eaten out on the taxpayers’ dime quite a few times while on “book fair” business.

The authors of this blog discovered that West Allegheny is sponsoring a B&N book fair the week after FC’s. And just as the B&N representative said, West A’s PTA takes care of the arrangements.

Fort Cherry’s PTA should too.

Perhaps the new board will consider the fact that an administrator who is able to spend so much time away from the district may not be needed by the district at all.

Let’s take a look at those receipts.

Spring 2010 Book Fair:

April 13, 2010 - Mileage: 33 miles @ $.55/mile.

Cost to taxpayers: $18.15

May 8, 2010 - “Materials”

May 14, 2010 - “Preparation” and “Books for Classrooms/Libraries” - that would be the Elementary Library (Code 10).

Spring 2011 Book Fair:

Take another look at the April/May/June 2011 reimbursement submittal above. Craig was reimbursed for food provided to our teachers who were diligently writing curriculum over the summer.

While the authors of this blog have concerns for all expenses, the significant issues here are Craig’s salary and her absence from the office.

Fort Cherry taxpayers are paying Craig, whose title is “Director of Curriculum”, a phenomenal salary. The information given in response to an RTK request for administrative compensation showed that Craig’s 2009/2010 salary was $100,854.22. Craig’s published salary is $81,916; her actual compensation included an additional $18,932.22.

At the same time, Fort Cherry taxpayers are paying teachers to write curriculum.

It’s been said that Craig has admitted that she “doesn’t like” writing curriculum.

Craig announced at the June 20, 2011, board meeting that she had 40 teachers writing curriculum over the summer.

The teachers were paid $18 an hour and were permitted to submit up to 24 hours of time.

That’s an additional $17,280 for curriculum writing.

Craig had interns take over after the teachers submitted their work.

If teachers and interns write the curriculum, what exactly is Craig’s role? The building principals can direct the teachers to write curriculum.

. . . spending time away from the district and

. . . spending taxpayer money.

-------

May 8, Masquerade – Materials????

This could be anything, not necessarily materials for the book fair.

Cost to taxpayers: $40.62

May 8, Target – Materials????

This receipt is illegible, this could be anything.

Cost to taxpayers: $22.37

May 8, Walmart – Materials – Glue?

Glue is readily available at FC.

Cost to taxpayers: $9.58

May 8, Michaels – Materials – foam, pom poms, pencils tattoos . . .

Cost to taxpayers: $40.26

May 14, Barnes & Noble – 3 beverages.

Cost to taxpayers: $6.68

May 18, Giant Eagle – Materials

Sroka did not provide this receipt in response to the right-to-know request.

Some of the items on the receipt, if not all, were more than likely available at FC.

The public has no way of knowing if Craig purchased school supplies or dinner for her family.

Cost to taxpayers: $18.13

May 14, Shop & Save - Gift Bags

Cost to taxpayers: $25.60

May 14, Red Robin – Lunch for teachers.

A hand-written tally? Did Craig create this list from memory?

FC District Policy #331 states, “In all instances of travel and job related expense reimbursement, full itemization of expenditures shall be required.” (http://fortcherry.schoolwires.net/fortcherry/lib/fortcherry/_shared/District_Policies/300_Administrative_Employees/331-Job_Related_Expenses.1.pdf)

Is this considered full itemization?

Cost to taxpayers: $47.98

Fall 2010 Book Fair:

October 10 and November 10, Mileage: 2 trips, 20 miles each @ $.50/ mile.

The mileage on the submittal above was 33 miles.

Shouldn’t the mileage be consistent?

Were two face-to-face meetings necessary?

Cost to taxpayers: $20.00

November 18, Cadillac Ranch – Lunch for Craig, Harvey, Delach and Bruschi???

Is Bruschi a FC employee?

Cost to taxpayers: $49.47

November 18, Target – Materials – batteries, tattoos, stickers, treat bags.

Cost to taxpayers: $33.06

November 18, Michaels – Materials – Handi Tak?

Handi Tak is readily available at FC. In addition, something that would take minutes to obtain from a supply closet at FC surely took longer than that to obtain from Michaels.

More shopping means more time away from the office.

Cost to taxpayers: $8.52

November 18, Kmart – Materials – batteries, more stickers.

Cost to taxpayers: $25.61

November 18, strike that, November 2, Walmart – Materials – more stickers and tattoos.

November 2! Another day to be out of the office . . . shopping!

Cost to taxpayers: $14.44

November 17, Giant Eagle – Materials – Baby Wipes.

It appears Craig was shopping on multiple days – not just November 18.

Cost to taxpayers: $4.58

November 17, Target, Washington, PA – Materials – hardware . . . hooks???

Cost to taxpayers: $27.81

November 17, Office Max – Materials – glue sticks, envelopes, ticket roll.

Glue sticks and envelopes available at FC.

Cost to taxpayers: $15.48

November 18, “Materials” - Bliss Avenue –– Face Paint?

Face paint??? . . .

Here’s a description of the store from Bliss Avenue’s website (parental discretion advised).

Bliss Avenue is the exciting new store that's all about "HER"! Escape reality, or create your own, with exotic lingerie, sexy costumes, clubwear, provocative intimate wear, boots and heels, accessories and more - it's all here!

From club and exotic wear to sleepwear and lingerie... fun accessories and make-up, bath and body products and oils and lotions. Bliss Avenue has an eclectic mix of all things sexy! Stop up and see us sometime!

Craig said the purchase was for face paint . . . is she referring to the “fun accessories and make-up” Bliss Avenue mentions on its website?

Due to the redactions on the receipt, the public is relying on Craig’s description of the purchase. The taxpayers can only hope it was “face paint” and that no personal purchases were made.

When contacted, Bliss Avenue stated that they don't sell face paint . . .so . . . what did Craig purchase???

Craig and Sroka charged the Bliss Avenue expense to Budget Code 2270 – 610 Instructional Staff Development Services - General Supplies . . .

General supplies for Instructional Staff Development??? . . . from Bliss Avenue? . . .

Seriously?

The item purchased may have been used for the staff’s “development” . . . but not any type of development appropriate for a school setting. . . and it’s highly unlikely that that the PDE has an appropriate account code for the items sold at Bliss Avenue.

Cost to taxpayers: $19.22

December 10, Ranger Depot – Prizes.

Cost to taxpayers $22.00

Spring 2011 Book Fair:

Planning begins for the next book fair . . .

March 25, 2011, Organization Meeting, Mileage: 19 miles (this time) @ .51/mile

Cost to taxpayers: $9.69

May 17, 2011, Setup at B&N, Mileage: 33 miles (this time) @ .51/mile

Cost to taxpayers: $16.83

With the date of this year’s book fair fast approaching (December 8), there were undoubtedly many more expenses incurred . . . “organization meetings”, “coordination meeting lunches”, “materials” . . . and a lot of time spent out of the office.

Perhaps the new board will consider the fact that an administrator who is able to spend so much time away from the district may not be needed by the district at all.

----------

Take another look at the April/May/June 2011 reimbursement submittal above. Craig was reimbursed for food provided to our teachers who were diligently writing curriculum over the summer.

While the authors of this blog have concerns for all expenses, the significant issues here are Craig’s salary and her absence from the office.

Fort Cherry taxpayers are paying Craig, whose title is “Director of Curriculum”, a phenomenal salary. The information given in response to an RTK request for administrative compensation showed that Craig’s 2009/2010 salary was $100,854.22. Craig’s published salary is $81,916; her actual compensation included an additional $18,932.22.

At the same time, Fort Cherry taxpayers are paying teachers to write curriculum.

It’s been said that Craig has admitted that she “doesn’t like” writing curriculum.

Craig announced at the June 20, 2011, board meeting that she had 40 teachers writing curriculum over the summer.

The teachers were paid $18 an hour and were permitted to submit up to 24 hours of time.

That’s an additional $17,280 for curriculum writing.

Craig had interns take over after the teachers submitted their work.

If teachers and interns write the curriculum, what exactly is Craig’s role? The building principals can direct the teachers to write curriculum.

Schools that are the size of Fort Cherry do not need a Director of Curriculum, especially one whose main job duty appears to be spending . . .

. . . spending time away from the district and

. . . spending taxpayer money.

-------