Fort Cherry is planning to upgrade the elementary playground.

Here’s the grant information from the Clorox website:

Promoting Healthy Living through PLAY!

Fort Cherry Elementary Center, McDonald, PA

Program Detail:

This grant would tie into our 2011-2012 Let's Get Fit program--getting up and moving. Our current plan incorporates a commitment to before, during, and after school exercise programming which started on Nickelodeon's Worldwide Day of Play. With the need to promote exercise, play, and life-long healthy living--we would like to provide an inviting outdoor area for our children to socially interact through exercise and play. In having an outdoor play area, we could enhance our goals of inspiring kids to be active; removing financial barriers to fitness; fostering interest in exercise; making healthy living sustainable; and reinforcing the importance of healthy lifestyles. In order to fulfill our commitment, WE NEED YOUR HELP! Our play area is old, worn, and archaic. Our plead is for a contemporary, age appropriate, and developmentally engaging outdoor play area for a K-6 building which incorporates children from ages 4-12. We are ready...CLOROX, help our school shine and our kids sparkle!

This grant would tie into our 2011-2012 Let's Get Fit program--getting up and moving. Our current plan incorporates a commitment to before, during, and after school exercise programming which started on Nickelodeon's Worldwide Day of Play. With the need to promote exercise, play, and life-long healthy living--we would like to provide an inviting outdoor area for our children to socially interact through exercise and play. In having an outdoor play area, we could enhance our goals of inspiring kids to be active; removing financial barriers to fitness; fostering interest in exercise; making healthy living sustainable; and reinforcing the importance of healthy lifestyles. In order to fulfill our commitment, WE NEED YOUR HELP! Our play area is old, worn, and archaic. Our plead is for a contemporary, age appropriate, and developmentally engaging outdoor play area for a K-6 building which incorporates children from ages 4-12. We are ready...CLOROX, help our school shine and our kids sparkle!

How this Grant will Help:

Our school is 22 years old and is in need of a new outdoor play area. We have been working to raise a minimum of $30,000 for this purchase. With the increase in our free/reduced lunch rate, decrease in our school budget, and fundraising at a max...we need help! We are excited for this opportunity--the amount of this grant could increase our scope to not only the purchase of a new play structure, but also the addition of a shade zone and soft safety floor. With the increasing concern about sun exposure, we would like to add a constructed shade area in which the children could play under during the warmer, sun exposed months. In addition, if we are fortunate enough to receive the Clorox grant, we would like to add a permanent soft surface instead of mulch--not only would a new soft surface be aesthetically pleasing, it may keep our kids safer and our building cleaner. Therefore, we hope to be selected to add a landscape play structure, shade sail area, and soft ground surfacing.

Our school is 22 years old and is in need of a new outdoor play area. We have been working to raise a minimum of $30,000 for this purchase. With the increase in our free/reduced lunch rate, decrease in our school budget, and fundraising at a max...we need help! We are excited for this opportunity--the amount of this grant could increase our scope to not only the purchase of a new play structure, but also the addition of a shade zone and soft safety floor. With the increasing concern about sun exposure, we would like to add a constructed shade area in which the children could play under during the warmer, sun exposed months. In addition, if we are fortunate enough to receive the Clorox grant, we would like to add a permanent soft surface instead of mulch--not only would a new soft surface be aesthetically pleasing, it may keep our kids safer and our building cleaner. Therefore, we hope to be selected to add a landscape play structure, shade sail area, and soft ground surfacing.

Sounds like the playground would be a great addition to the elementary.

During the September 26th board meeting, Jacoby announced that she applied for this grant. (http://www.fortcherry.org/17031051991440767/lib/17031051991440767/_files/Sept_26_2011.pdf)

The authors of this blog sincerely hope the District is successful in winning the grant.

However, if Fort Cherry wins, ALL of the money should go toward the playground.

That may not be so.

According to FC’s Act 93 Administrative Compensation Plan, administrators are awarded 5% of any grants they obtain for the district.

ACT 93 AGREEMENT between the

FORT CHERRY SCHOOL DISTRICT and the

FORT CHERRY SCHOOL DISTRICT AMMINISTRATORS

July 1, 2010 – June 30, 2016

A $50,000 grant would give Jacoby a $2,500 bonus; and take $2,500 away from our children.

It’s entirely possible that if any other administrators signed on to this grant, like Dinnen and Craig, they would be given bonuses too, taking even more from the children.

Fort Cherry’s Act 93 Compensation Plan is extremely generous.

For example, FC’s Act 93 gives full tuition reimbursement and provides a $5000 annual stipend for each doctorate held by FC administrators.

By comparison, Upper St. Clair gives its administrators a one-time $2000 stipend for earning a doctorate degree. (http://webinfo.uscsd.k12.pa.us/_schoolwires/district/pdf/Act93Admin2010.pdf)

According to a former board member who was on the board in 2005, the doctorate stipend was initiated by Dinnen.

As the former board member described it, it was Dinnen who approached the board in 2005 and requested the $5000 bonus be added to the Act 93 compensation plan.

He went on to say that Dinnen told the board that it was the only way FC could hang on to Jacoby, who was working on her doctorate at the time.

At the time of the addition of the $5000 stipend to the Act 93, Dinnen had acquired his second doctorate (full tuition reimbursement courtesy of FC taxpayers), entitling him to $10,000 per year.

==================================================

Fort Cherry School Board

--------------------------------------------------

Observer-Reporter (Washington, PA)-June 29, 2005

* Date: June 27

* Action: The board unanimously approved a five-year administrative compensation plan effective at the beginning of the 2005-06 school year. There are two new provisions in the plan.

If teachers before 2009 have a co-pay as part of their health-care coverage, administrators also will be subject to a co-pay. After 2009, when the current collective bargaining agreement with the teachers union expires, if teachers are subject to a co-pay, administrators also will be subject to a co-pay.

The second provision creates an annual $5,000 payment, over and above the base salary, for administrators who obtain a doctorate degree. Business manager Paul Sroka equated the compensation to which teachers receive when they obtain a master's degree.

The board unanimously approved the following administrative salaries for the 2005-06 school year: Superintendent Robert Dinnen, $92,814; business manager Paul Sroka, $64,164; high school principal Fred McGivern, $71,050; assistant high school principal Mark Abbondanza, $61,290; elementary school principal Jill Jacoby, $71,925; special education coordinator Ryan Cole, $58,777; curriculum coordinator Trish Craig, $62,975; facilities manager Bob Zyra, $45,718; and director of support services and transportation Jeff Marquis, $55,083. Administrative raises range from 1.5 to 2.75 percent.

* Next meeting: 7:30 p.m. July 25 at the elementary center.

The bonuses received from grants, tuition stipends, and other administrative perks outlined in the Act 93 agreement are added to the administrators’ compensation and should appear on their W-2 or 1099 forms.

If you factor in the Act 93 benefits, as well as generous insurance buy-outs and liberal employee reimbursements, administrative pay is likely well above published amounts.

As discussed in the October 15th post, the District is using taxpayer funds to fight the release of the administrators’ compensation information. (See “What’s Up with the W-2s?” http://fortcherryinfo.blogspot.com/2011/10/whats-up-with-w-2s.html)

As long as the District continues to fight the release of the W-2 and 1099 forms, true administrative compensation will remain unknown to the public. The public is paying this amount, whatever it is.

In the article above, Jacoby asks the community to “help our schools shine and our kids sparkle.”

The community is asked to help with the fundraising and participate in the grant challenge . . .

. . . however . . .

According to the article, “FC needs a minimum of $30,000 to acquire the new playground equipment”.

The article quotes Jacoby as saying, “We’re trying to meeting the developmental needs of each grade level.”

If both of those statements are true, why not meet those needs by budgeting for the playground?

Why rely on fundraising and grants?

FC budgeted $37,635 for conference and travel. (See “FC Administration . . . On the Road Again . . . and again” http://fortcherryinfo.blogspot.com/2011/10/fc-administration-on-road-again-and.html)

FC needs $30,000 for new playground equipment.

The solution is simple - eliminate administrative travel, like other area schools have done, and use the money for the children, as it should be used.

Fort Cherry needs to get back to the business of educating and nurturing our children, instead of indulging the administration.

Then we’ll see our schools shine and our kids sparkle.

By the way, take note of this statement in the “Program Detail” of the grant application above:

“In having an outdoor play area, we could enhance our goals of inspiring kids to be active; removing financial barriers to fitness; fostering interest in exercise; making healthy living sustainable; and reinforcing the importance of healthy lifestyles.”

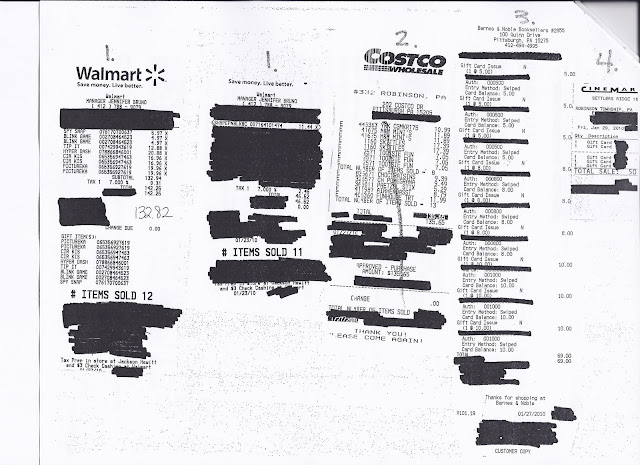

Let’s take a look at the receipts Jacoby submitted for reimbursement for the past few years. You’ll notice a LOT of candy.

Fritos . . . Cheez-Its . . . Tootsie Rolls . . . Chocolate Muffins . . . RedFish . . . Twizzlers . . . Air Heads . . . Blow Pops . . . M & M’s . . . Skittles . . . Air Heads . . . Ring Pops . . . Oreos . . . Tootsie Pops . . . M & M’s . . . Candy Variety . . .

$1075.96 for candy rewards

It doesn’t seem like those purchases “reinforce the importance of healthy lifestyles”.

Take note that all the time stamps have been redacted from the receipts. The redactions raise the question of when all this shopping took place – it’s very possible the shopping took place during the school day.

Also of interest is the accounting function code used to pay for candy expenditures.

On each reimbursement form submitted by Jacoby, you’ll see an expenditure code and object dimension charged for the expense (underlined in red). The codes can be found in the PDE’s Chart of Accounts: http://www.portal.state.pa.us/portal/server.pt/community/school_finance/7307/hide_chapters_(manual_of_accounting).

The definition of the codes (obtained from the Chart of Accounts) is shown under each reimbursement form.

Perhaps because the PDE did not provide an object dimension for candy in the Chart of Accounts, the accounts charged are not consistent.

Or perhaps it’s just creative accounting.

These indulgences do not occur in the high school.

However Jacoby is consistently permitted to make these types purchases.

Here are Jacoby’s submittals:

EXPENDITURE FUNCTION:

2380 * OFFICE OF THE PRINCIPAL SERVICES

Those activities concerned with directing and managing the operation of a particular school. It includes the activities performed by the principal, assistant principals, and other assistants in general supervision of all operations of the school, evaluation of the staff members of the school, assignment of duties of staff members, supervision and maintenance of the records of the school, and coordination of school instructional activities with instructional activities of the LEA. It includes clerical staff for these activities.

OBJECT DIMENSION:

890 MISCELLANEOUS EXPENDITURES

Expenditures for goods or services not properly classified elsewhere in the 800 series of accounts.

FUNDING SOURCE:

200 STATE PROJECTS

Expenditures that require specialized reporting for categorically funded state programs. Accounts may be set up within this state project classification for state matching moneys for Federal grants.

In the Chart of Accounts, “Funding Source 200” is further broken down into individual grants.

Because the general number “200” was used, the public has no idea which grant actually paid for the candy.

Listed below are just a few of the grants which could have been used:

201 Basic Education

207 School Improvement Grants

208 Staff And Program Development

209 Charter School Programs – State Sources (Transitional Grants, Nonpublic Transfers, State Funded Start-Up Money)

211 Tutoring

212 PA Accountability Grants

217 Pre-K Counts

218 Full Day Kindergarten Supplement

221 Accountability to Commonwealth Taxpayers (ACT)

Here is the receipt Jacoby submitted for the reimbursement:

M & M’s . . . Candy Variety . . . Twizzlers . . . Oreos . . .

Is candy a wise use of grant money?

EXPENDITURE FUNCTION:

2380 * OFFICE OF THE PRINCIPAL SERVICES

Those activities concerned with directing and managing the operation of a particular school. It includes the activities performed by the principal, assistant principals, and other assistants in general supervision of all operations of the school, evaluation of the staff members of the school, assignment of duties of staff members, supervision and maintenance of the records of the school, and coordination of school instructional activities with instructional activities of the LEA. It includes clerical staff for these activities.

OBJECT DIMENSION:

890 MISCELLANEOUS EXPENDITURES

Expenditures for goods or services not properly classified elsewhere in the 800 series of accounts.

Oreos . . . Tootsie Pops . . .

EXPENDITURE FUNCTION:

2120 * GUIDANCE SERVICES

Activities involving counseling with students and parents, providing consultation with other staff members on learning problems, evaluating the abilities of students, assisting students as they make their own educational and career plans and choices, assisting students in personal and social development, providing referral assistance, and working with other staff members in planning and conducting guidance programs for students. (Expenditures may be charged to the following sub-accounts.)

OBJECT DIMENSION:

610 GENERAL SUPPLIES

Expenditures for all supplies (other than those listed below) acquired for the operation of the LEA, including freight and cartage. Consumable teaching and office items such as paper, pencils, forms, postage, blank diskettes, blank CD-ROMs, blank videotapes, and other supplies of relatively low unit costs, necessary for instruction and / or administration should be included in this category. (A more specific classification is achieved by identifying the function chargeable.)

Interesting . . . Jacoby had this coded under “890 – Miscellaneous Expenditures”. It appears Sroka changed it. Is “610 – General Supplies” a better fit, or did the money run out in the “890 - Miscellaneous Expenditures” category?

Tootsie Rolls . . . Twizzlers . . . Redfish . . . . Ring Pops . . . Skittles

This reimbursement was for Accelerated Reader Awards, just like the one from May 2009 shown below, yet it is charged to different account codes.

EXPENDITURE FUNCTION:

2380 * OFFICE OF THE PRINCIPAL SERVICES

Those activities concerned with directing and managing the operation of a particular school. It includes the activities performed by the principal, assistant principals, and other assistants in general supervision of all operations of the school, evaluation of the staff members of the school, assignment of duties of staff members, supervision and maintenance of the records of the school, and coordination of school instructional activities with instructional activities of the LEA. It includes clerical staff for these activities.

OBJECT DIMENSION:

890 MISCELLANEOUS EXPENDITURES

Expenditures for goods or services not properly classified elsewhere in the 800 series of accounts.

M & Ms . . . Skittles . . . Tootsie Rolls . . . Air Heads . . .

. . . and . . . Barnes & Noble gift cards . . .

The Barnes & Noble gift card numbers are redacted. The public has no way of tracking the recipients of these cards . . . students . . . faculty . . . family members?

EXPENDITURE FUNCTION:

1100 * REGULAR PROGRAMS – ELEMENTARY / SECONDARY

Activities designed to provide grades K–12 students with learning experiences to prepare them for activities as citizens, family members, and non-vocational workers as contrasted with programs designed to improve or overcome physical, mental, social and / or emotional handicaps.

OBJECT DIMENSION:

610 GENERAL SUPPLIES

Expenditures for all supplies (other than those listed below) acquired for the operation of the LEA, including freight and cartage. Consumable teaching and office items such as paper, pencils, forms, postage, blank diskettes, blank CD-ROMs, blank videotapes, and other supplies of relatively low unit costs, necessary for instruction and / or administration should be included in this category. (A more specific classification is achieved by identifying the function chargeable.)

Twizzlers . . . Air Heads . . . Tootsie Rolls . . . Blow Pops . . .

. . . more untraceable gift cards . . .

Another Accelerated Reader assembly . . .

EXPENDITURE FUNCTION:

1100 * REGULAR PROGRAMS – ELEMENTARY / SECONDARY

Activities designed to provide grades K–12 students with learning experiences to prepare them for activities as citizens, family members, and non-vocational workers as contrasted with programs designed to improve or overcome physical, mental, social and / or emotional handicaps.

OBJECT DIMENSION:

599 Other Miscellaneous Purchased Services

Expenditures for other miscellaneous purchased services not classified elsewhere in the 500 series of objects.

Blow Pops . . . Twizzlers . . . Redfish . . . and gift cards.

. . . more untraceable gift cards . . .

EXPENDITURE FUNCTION:

2380 * OFFICE OF THE PRINCIPAL SERVICES

Those activities concerned with directing and managing the operation of a particular school. It includes the activities performed by the principal, assistant principals, and other assistants in general supervision of all operations of the school, evaluation of the staff members of the school, assignment of duties of staff members, supervision and maintenance of the records of the school, and coordination of school instructional activities with instructional activities of the LEA. It includes clerical staff for these activities

OBJECT DIMENSION:

890 MISCELLANEOUS EXPENDITURES

Expenditures for goods or services not properly classified elsewhere in the 800 series of accounts.

Fritos . . . Cheez-Its . . . Tootsie Rolls . . . Chocolate Muffins . . . RedFish . . .

$1075.96 for candy rewards.

More receipts and more creative accounting in future posts . . . stay tuned.